![PingPong_Logo [Blue]-3](https://usa.landing.pingpongx.com/hs-fs/hubfs/PingPong_Logo%20%5BBlue%5D-3.png?width=161&height=50&name=PingPong_Logo%20%5BBlue%5D-3.png) x

x %20(1)-2.png?width=96&height=54&name=CTC%20Logo%20Low%20Res%20(2)%20(1)-2.png)

WE GET BY WITH A LITTLE HELP FROM OUR FRIENDS

Get Down to Better Business with PingPong

PingPong comes together with the best-in-class financial Institution like Canadian Tax Compliance to help you optimize your online business operations, grow revenue, improve customer experience, enhance technology and so much more.

PingPong is packed with tools you need to scale your cross-border eCommerce business

Supplier Payment

Virtual Wallet

Pay VAT & GST

API Integration

Payroll & Quickbook

"PingPong can save you on any of your local and oversea payments. It is packed with tools you need to scale your business"

Simplified Supplier Payments

Multi-currency Virtual Wallet

Easy VAT & GST Payments

Quick Integration Quickbook & Xero

Accept Marketplace Payouts

How it Works

Sign Up

Register for a free account.

PingPong has a team of Onboarding Consultants who specialize in oversea business. We work with you closely and guide you through preparing materials for your company's business verification.

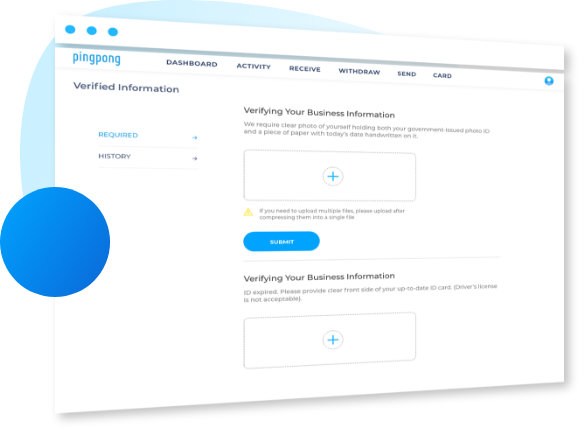

Business Verification

Upload the required (standard) business documents.

24-Hour Support.

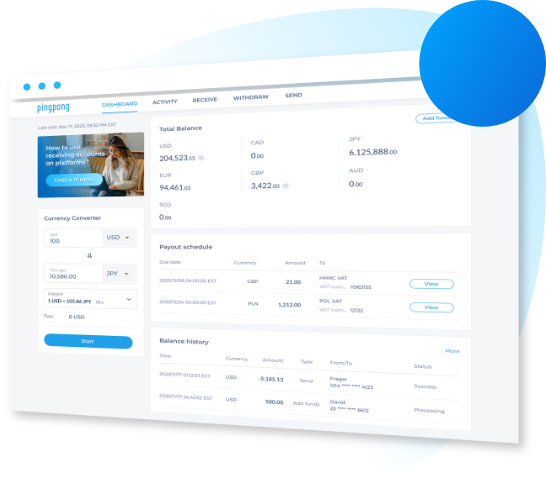

Receive, Send & Save

Receive payouts from marketplaces, Send money to your offshore suppliers. Open virtual currency accounts, Pay VAT and GST online. Top-up your account and so much more on a single, convenient platform.

Participating in Payment Services Provider Program with

Frequent Questions

PingPong abides by industry standards when it comes to safeguarding your money and information. Its website uses standard Secure Sockets Layer (SSL) encryption to protect your information. Access to your personal data is also limited to employees who need it for business purposes and who’ve been trained in confidentiality best practices.

Outside of company policies, PingPong also follows government standards for all the countries it operates in. For the US, it’s registered with the Financial Crimes Enforcement Network and is regulated by the EU’s General Data Protection Regulation.

Straight forward, Wikipedia definition: The know your customer or know your client (KYC) guidelines in financial services requires that professionals make an effort to verify the identity, suitability, and risks involved with maintaining a business relationship. The procedures fit within the broader scope of a bank's Anti-Money Laundering (AML) policy.

PingPong participates in KYC (Know Your Customer) for YOUR protection and safety.

KYC submission helps prevent money laundering and account fraud by verifying your identity and preventing anyone who isn’t you access to your account and information.

Yes, with PingPong, you can accept international payments in all major currencies (GBP, USD, EUR, HKD, CAD, AUD, JPY, MXN, AED, SGD, PLN) with highly competitive foreign exchange rates, which can get you 8x cheaper than marketplaces and banks.

Yes! PingPong has a global tax portal that allows users to pay their international tax needs quickly and easily. You can use your existing balance of local funds to make that transfer without dealing with or paying any conversion costs.

Yes! You can add funds to your PingPong account or use your existing funds on balance to make payments all over the world in almost every currency.

If your supplier/receiver also has a PingPong Account then you can utilize the in-network payment and the funds will arrive almost instantly and the payment costs nothing!

-3.png)